Canada GST62 E 2011-2026 free printable template

Fill out, sign, and share forms from a single PDF platform

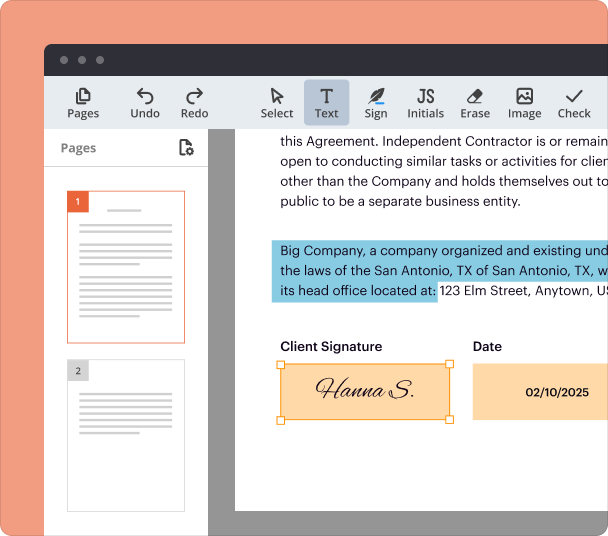

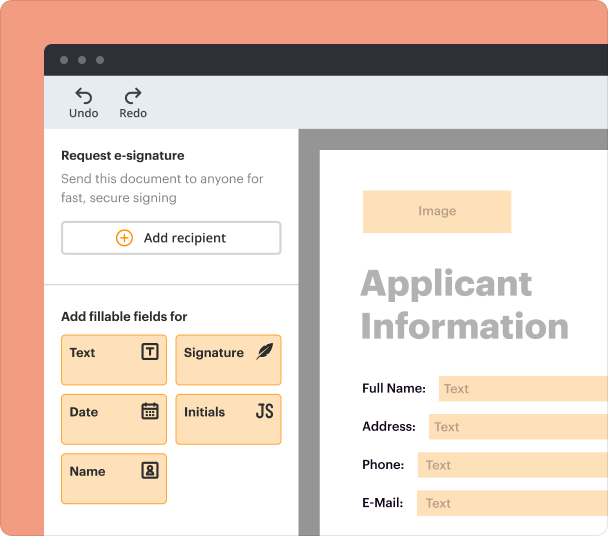

Edit and sign in one place

Create professional forms

Simplify data collection

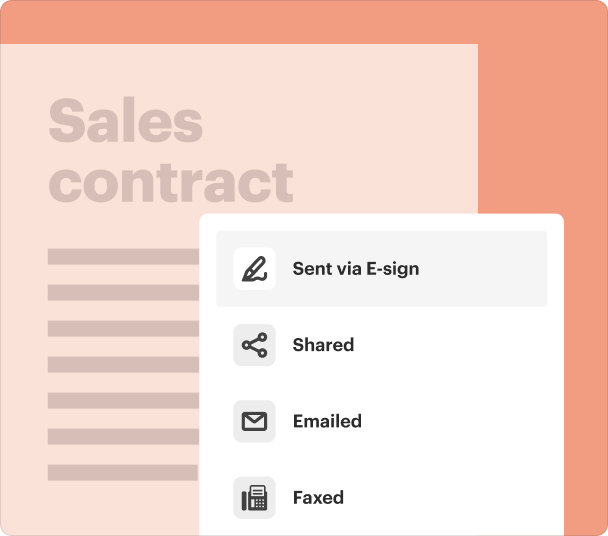

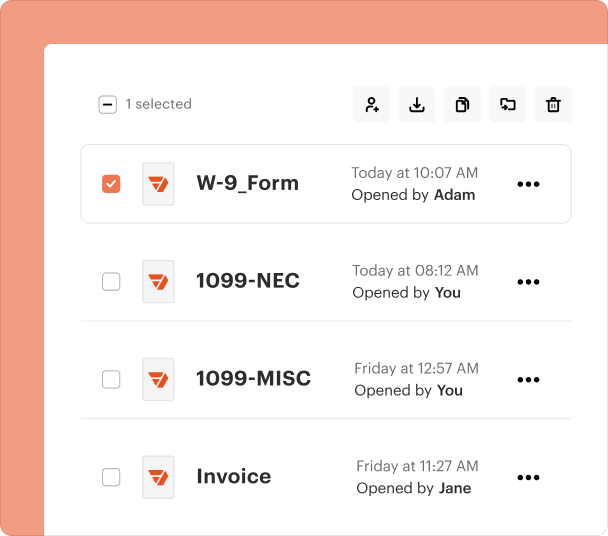

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Navigating the Canada GST62 E Form: Your Comprehensive Guide

How do fill out the Canada GST62 E Form?

To fill out the Canada GST62 E Form, begin by understanding its purpose and requirements. This guide will take you through each step of the process, ensuring that you can complete the form correctly and efficiently.

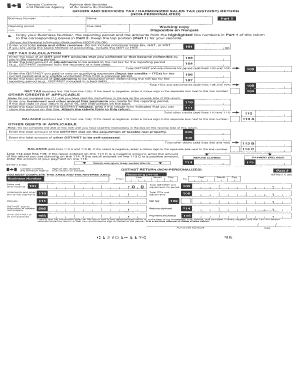

Understanding the Canada GST62 E Form

The Canada GST62 E Form is a tax-related document that is essential for claiming input tax credits. It serves businesses and individuals by facilitating the reporting of GST collected on taxable supplies in Canada.

-

The GST62 E Form is designed to report GST/HST amounts collected or paid, allowing claimants to recover costs associated with business activities.

-

Filing this form is crucial since it affects cash flow by ensuring timely tax refunds from the Canada Revenue Agency (CRA).

-

Unlike other tax forms, the GST62 E Form particularly pertains to GST/HST input tax credits, making it unique in its applicability.

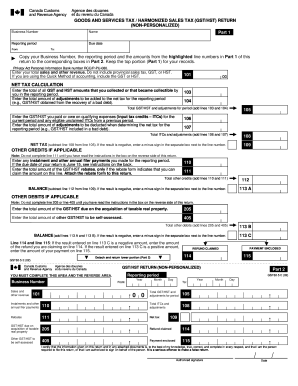

Who needs to use the Canada GST62 E Form?

The form is a requirement primarily for registered businesses that charge GST/HST on their goods or services.

-

To use the form, one must be a GST/HST registrant and have incurred eligible expenses that involve tax.

-

Businesses in retail, hospitality, and professional services commonly find this form applicable when dealing with significant tax inputs.

-

For example, a restaurant must use the form to claim back the GST paid on supplies like food ingredients or kitchen equipment.

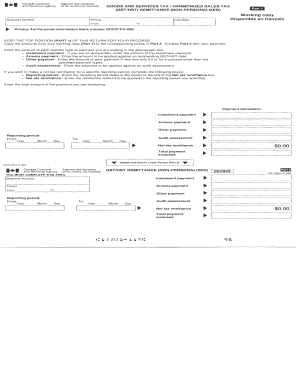

What is the step-by-step guide to filling out the Canada GST62 E Form?

Completing the GST62 E Form accurately necessitates careful attention to its sections.

-

Begin with personal or business information before proceeding to financial details, ensuring that values entered correspond correctly to the respective fields.

-

Many individuals miscalculate their input credits, leading to rejected claims. Double-checking figures helps mitigate this risk.

-

Utilizing pdfFiller’s interactive tools simplifies the process, providing additional prompts and form validation to ensure correctness.

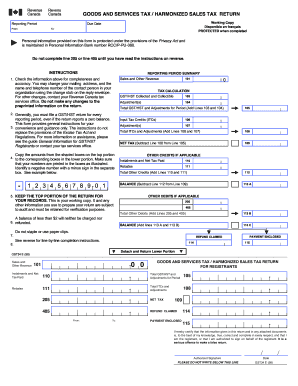

Managing and editing your GST62 E Form with pdfFiller

pdfFiller offers an array of features ideal for managing your GST62 E Form without hassle.

-

With pdfFiller, users can easily edit PDF forms using tools that allow text, images, and annotations to be added seamlessly.

-

Teams can utilize collaborative features that provide shared access to forms, making it easier to review and finalize tax documents together.

-

Users can securely sign their documents digitally, ensuring compliance and security when submitting their forms on the platform.

What are the compliance and important considerations?

Filing the GST62 E Form requires adherence to specific guidelines and deadlines.

-

It's vital to stay updated on CRA regulations regarding submissions to avoid penalties.

-

Ensure that your form is submitted within the designated time frame, typically quarterly or annually depending on your business filings.

-

If a mistake is made on your form, promptly reach out to the CRA to rectify the errors and avoid future issues.

How can you get started with your GST62 E Form today?

Beginning your GST62 E Form is simple with pdfFiller's user-friendly platform.

-

You can access the GST62 E Form through pdfFiller’s platform immediately, allowing for quick initiation of the filling process.

-

The site offers various templates for the GST62 E Form that you can edit and sign, streamlining your workflow.

-

Using pdfFiller not only simplifies the document process but also consolidates your document needs into one secure, cloud-based solution.

Frequently Asked Questions about gst remittance forms printable

What is the purpose of the Canada GST62 E Form?

The Canada GST62 E Form is used to claim input tax credits on goods and services purchased for tax purposes. It ensures businesses can recover the GST/HST paid on their expenses.

Who qualifies to fill out the GST62 E Form?

Any registered business that pays GST/HST can fill out the GST62 E Form. Eligibility may vary based on the sector and specific business conditions.

What are the deadlines for submitting the GST62 E Form?

Deadlines for submitting the GST62 E Form depend on your reporting period. Generally, this is quarterly or annually, and it’s critical to adhere to these timelines to avoid penalties.

Can I edit the GST62 E Form after submission?

Once submitted, modifications to the GST62 E Form are limited. If you discover an error, you should communicate with the CRA immediately to correct it.

How does pdfFiller streamline the GST62 E Form process?

pdfFiller simplifies the GST62 E Form process through its editing tools, collaboration features, and secure signing capabilities, providing an all-in-one platform for handling document needs.

pdfFiller scores top ratings on review platforms