What is a HST/GST Return Form?

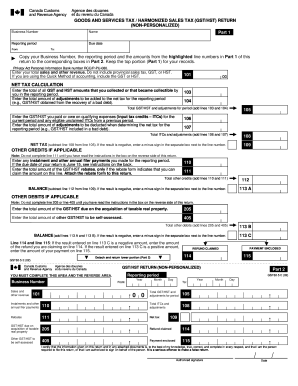

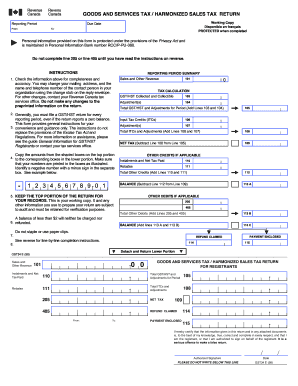

The HST/GST Return Form stands for the Goods and Services Tax/Harmonized Sales Tax Return (Non-personalized). It is a complicated form and requires some time to figure out all aspects of completion. That is why you need to check the instructions to this document to avoid mistakes. If you are registered as HST or GST, you must file this form. If you are not registered, this form is useless for you.

What is HST/GST Return Form for?

This form is designed for reporting the harmonized sales tax or goods and services tax. It is a Canadian form that requires many calculations to be made.

When is the HST/GST Return Form Due?

For people who file their tax return annually, the due date is June 15th. Stick to this date. If you fail submitting the form by this date, the penalties may be imposed. The due date must be indicated on the top of the form.

Is the HST/GST Return Form Accompanied by Other Documents?

The only documents that you may need to attach are the checks that confirm your payments.

What Information should I Include in the HST/GST Return Form?

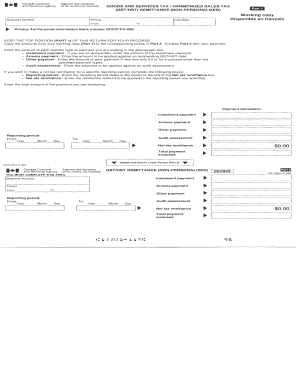

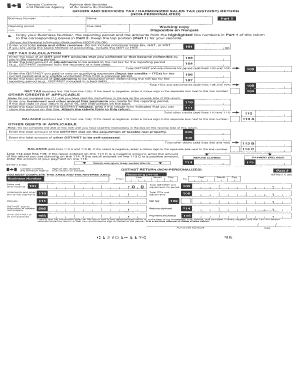

Most of the form is devoted to net calculations. However, before starting to calculate your tax, you must indicate business number, name, due date and reporting period. Then go on to calculate your tax. You must enter total amounts collected during a certain period. After that you must describe your credits and debits. The following details must also be indicated in the form:

-

Sales and other revenue;

-

Installments;

-

Other annual payments;

-

Rebates;

-

Refunds, etc.

Where should I Send the HST/GST Return Form?

You must personally take your completed return to the Tax Office or Tax Center. Otherwise, you may fax it and still come to your tax institution in person.